Little Known Facts About 3 Things To Avoid When Filing Bankruptcy.

Our cost-free Resource has helped 14,056+ families file bankruptcy by themselves. We're funded by Harvard University and won't ever check with you for your bank card or payment.

You'll have to evaluation your credit history report and any selection notices you’ve obtained from the mail to verify your entire debts are A part of your petition. You'll also require the final 6 months of fork out stubs and with Every pay out time period.

When you've got a co-signer on any of your respective debts, creditors may still be able to pursue them for the harmony, regardless of whether the credit card debt is discharged inside your bankruptcy. If you co-personal a company, your associate may very well be needed to buy you out to take care of the organization.

Filing bankruptcy at this time may well even make your predicament worse because if you later confront a home foreclosure or motor vehicle repossession (for a auto you've reaffirmed) after you filed for bankruptcy, you will need to hold out 8 several years before you can file Chapter seven bankruptcy all over again.

You need to also file and fork out applicable taxes throughout the bankruptcy procedure or submit an application for an extension. Your case can be dismissed if you fall short to file your return or spend taxes throughout the bankruptcy approach.

And even though Chapter thirteen bankruptcy allows you to maintain your belongings although generating payments on an adjusted debt prepare, should you default on the repayments, These property could be at risk.

Listed here’s Recommended Reading what you need to know about the implications of filing for bankruptcy as well as some options to consider.

Should you file beneath Chapter 13 instead, you could maintain all of your current house, but you will have to repay your creditors the worth of any non-exempt home by way of straight from the source a repayment plan that's administered by a trustee.

Calculate the amount of cash you have got still left in excess of monthly right after creating financial debt payments and paying for critical expenses — then start out crafting a more streamlined budget. Do away with unneeded bills

The secured debts for instance a car or truck will should be dealt with about this point in the process. You can typically reaffirm the debt being an asset, that is quite common More hints for automobiles.

LegalZoom delivers use of impartial Lawyers and self-company instruments. LegalZoom just isn't a law firm and does not give authorized guidance, apart from wherever approved through its subsidiary regulation agency LZ Authorized Expert services, LLC. Use of our services is governed by our Conditions of Use and Privateness Policy.

Just before acquiring a aspect occupation, make sure you’re obtaining the most out of your primary position. Conversing directly to your supervisor about a elevate might be scary, but advocating for address yourself from the office can pay off.

Embark on the journey to enduring enterprise achievement, wherever monetary freedom paves the best way to prosperity. Think about a future in which your company thrives unencumbered through the burdens of monetary obligations, and each final decision you make propels you closer for your goals.

The couple then started creating payments to their trustee, who her comment is here conveyed the money to creditors and monitored Bill and Kathy’s development.

Val Kilmer Then & Now!

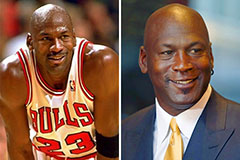

Val Kilmer Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!